Post-Pandemic Land Prognosis

It’s certainly been a tumultuous few years for Texas’ land markets, what with demand plummeting in the first half of 2020 only to unexpectedly take off again in the second half of the year. Two years later, the market appears to have settled down again.

What factors have been driving demand for rural land the past few years, and what questions are market experts asking going into 2023?

How Land Market Dynamics Changed in 2020, and Why

Canceling concerts, closing restaurants, shuttering bars, and prohibiting gatherings, cities shut down most public interaction in 2020 to reduce the spread of COVID. Suddenly, urban dwellers faced the prospect of quarantining at home or risking an infection when they ventured out.

The pandemic forced city-dwellers to work online from home and shift gatherings such as churches, schools, and conferences from in-person to virtual. Oil prices collapsed as travel ground to a halt.

Brokers reported that some clients were concerned about violence and unrest in the city, and that was their motivation for buying rural property.

These developments brought Texas land market activity to a standstill in 2020. Brokers’ phones went silent. Second quarter total sales dropped 9 percent below the 2019 second quarter numbers, and land market professionals braced for significant downward pressures on prices.

Unexpected Shift in Demand

Surprisingly, by third quarter 2020 those COVID-induced conditions inspired a stampede of newly sequestered Texans to the countryside searching for land. Rural transaction numbers soared as urban dwellers descended on bucolic areas, seeking escape from cities. They could work and conduct conferences from home. They could venture out in sparsely populated communities with a much lower probability of exposure to infected people. They felt safer in rural Texas.

Third-quarter 2020 transaction totals soared 47 percent higher than 2019. The fourth quarter shot up 85 percent followed by a 69 percent first-quarter 2021 increase over the anemic 2020 total. The explosion of activity continued with a 71 percent second-quarter increase.

Third quarter 2020 through third quarter 2021 was perhaps the most remarkable period Texas’ land market has ever experienced. Brokers had difficulty setting asking prices on listed properties as motivated would-be buyers made offers exceeding recent norms. The statewide price increased 26 percent from second quarter 2020 through third quarter 2021. Although subsequent quarters began posting smaller volumes of sales, prices continued to climb. The statewide price per acre shot up from $2,969 in second quarter 2020 to $4,426 in third quarter 2022, a 49 percent increase in two and a half years.

The figure shows the stampede’s effect on sales volume (number of sales) and price (dollars per acre). Demand began to soar in third quarter 2020. That explosion of activity, followed by three more quarters of rapid sales growth, initiated a remarkable run-up in price per acre beginning in first quarter 2021. Prices rose 9 percent year over year, exploded in the second quarter to 18 percent, then peaked at 29 percent in fourth quarter 2021.

Cooling Demand in 2022

Price growth continued to increase at a substantial 19 percent in third quarter 2022. Meanwhile, quarterly sales volumes have declined from the previous year’s feverish activity level.

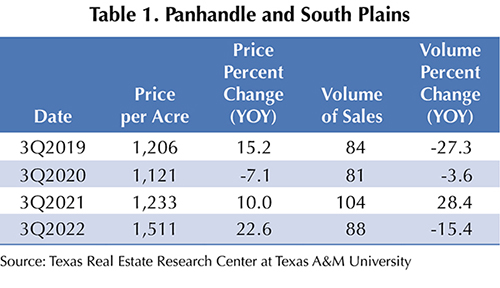

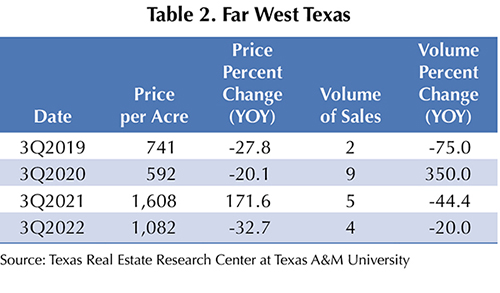

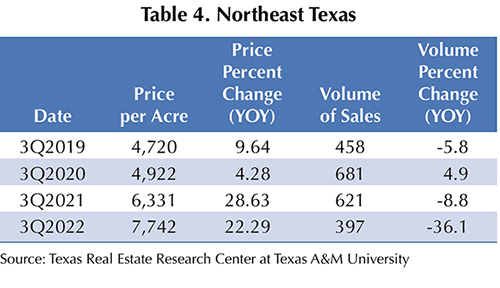

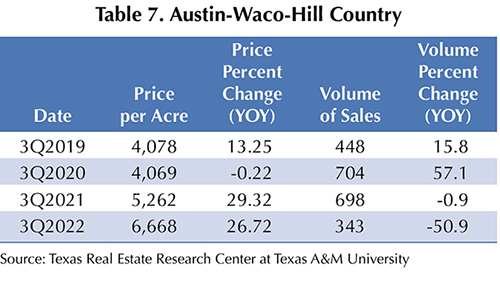

Tables 1 through 7 provide an analysis of regional Texas market dynamics, showing prices and numbers of sales in the second quarter of each year from 2019 through 2022. In all regions except Far West Texas, volume exploded in second quarter 2021, instigating record price increases the following year. Virtually all regions posted declining activity in second quarter 2022, coinciding with the declining rate of price growth shown in the figure.

These developments suggest activity has slowed. However, that slowdown occurred after a historic explosion in demand for land. As the fall unfolds, the hoard of would-be buyers appears to have diminished to a smaller gang struggling to find properties listed for sale. Faced with few attractive potential opportunities, landowners have opted to hold onto their land rather than sell and find other investments. The pressure of heavy demand appears to be waning, but it has not vanished, and sales prices continue to climb at a more modest pace.

The resumption of in-office work, restored popularity of in-person conferences, and new landowners’ experience of the realities of property maintenance have pushed down demand for rural land, and rising interest rates may further cool demand pressures. The next few quarters may produce interesting developments in land markets.

Given the realities of ownership, will the newest cohort of landowners stay the course? Will new buyers continue to enter the market? Will buyers of all types become more discriminating regarding the quality of individual tracts? The Texas Real Estate Research Center will continue to monitor market activity and report new trends.

To track the latest regional land market developments, see the Center’s data page.

____________________

Dr. Gilliland ([email protected]) and Dr. Krebs ([email protected]) are research economists with the Texas Real Estate Research Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.