El Paso

The Department of Defense’s military base realignment of 2005 boosted El Paso’s housing market and blunted the impact of the Great Recession. Recently, though, the city has felt the effects of trade uncertainty and diminishing manufacturing output. |

El Paso’s economy has much to offer, but probably the largest and most influential contributor is Fort Bliss, located in the middle of the city. As home to one of the largest military bases in the nation, El Paso is always in tune to the latest Base Realignment and Closure (BRAC) developments. While base closures negatively affected many markets around the country, Fort Bliss actually expanded because of realignment, giving the city a boost. However, recent factors have begun cooling the city’s housing market.

BRAC Boost and the Great Recession

The Department of Defense’s 2005 decision to relocate the 1st Armored Division to Fort Bliss was a major economic boon for the area. The timing of the announcement helped jump-start El Paso’s housing market briefly before the start of the U.S. mortgage meltdown crisis. The news sparked anticipation of thousands of new troops and their families, many of whom would gradually migrate into the area in the years to come.

Several local housing metrics shifted right after BRAC. In the first half of the 2000s, home-price appreciation grew at the same pace as the state, but after 2005, El Paso prices quickly shot up (Figure 1). Price growth expanded the most between 2005 and 2007, causing the single largest price hike in the area since at least 2000. The median days on market for a Multiple Listing Service sale was more than three months in 2004 but around 20 days for much of 2006.

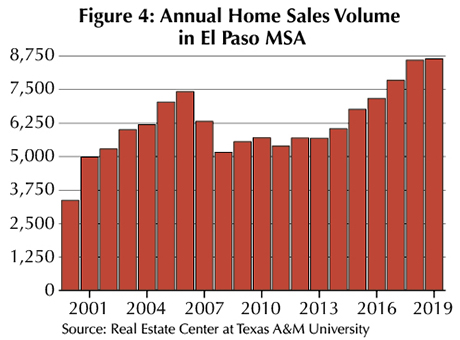

The Great Recession (GR) took a toll on El Paso housing markets. After major gains in 2005 and 2006, home sales, prices, and marketing periods declined. Home sales suffered the most, dropping from almost 7,500 transactions at the peak in 2006 to barely over 5,000 in 2008. Over the same period, price growth slowed, and days on market reverted to around two to three months. Despite the immediate pullback, Fort Bliss’ expansion had a lasting impact on El Paso’s housing market, blunting the impact of the GR for years to come.

Construction Boom

Fort Bliss’ expansion ushered in a regional construction boom both directly and indirectly tied to the military. Besides Fort Bliss expansion, major projects included various healthcare-related projects, downtown redevelopment, and new-home construction. In fact, El Paso was likely one of the few bright spots nationally for residential construction.

El Paso has fewer land development options for new housing communities than other Metropolitan Statistical Areas (MSAs) of its size (see map). This is due to its enclosure by Mexico, New Mexico, Fort Bliss, and the Franklin Mountains. For this reason, much of the new housing development is typically wedged between US 180 and I-10.

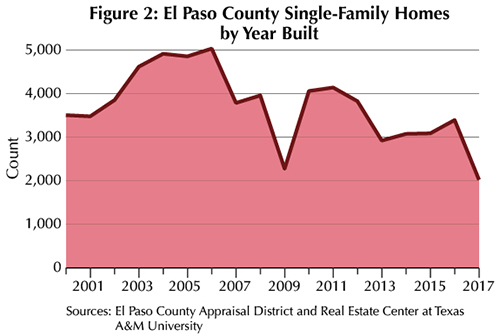

Residential construction in El Paso exploded in the mid-2000s to levels not seen before or since, but the GR took a major bite out of new home output by 2007 that lasted until 2009 (Figure 2). According to tax records of when homes were originally built, new single-family home output peaked in 2006 at around 5,000 homes but then plummeted to less than half that amount by 2009. Output wouldn’t be down for long, with 2010 and 2012 rebounding to more than 4,000. Over the remainder of the 2010 decade, new-home construction continued to slow but at levels still above the long-term average.

Commercial general contractor jobs grew rapidly between 2005 and 2008 before gradually declining over the next five years (Figure 3). Commercial jobs peaked again in 2016 in large part because of construction of the William Beaumont Army Medical Center and various downtown redevelopment projects.

Residential general contractor jobs began expanding as early as 2003 before leveling off five years later. While the nation was in the worst of the housing mortgage crisis, El Paso’s residential construction employment remained resilient.

Current Housing, Economic Conditions

Household growth in El Paso has been up and down over the past 30 years. Based on U.S. Census Bureau estimates, the MSA gained nearly 10,000 net households between 2010 and 2018 at an average annual rate of less than 1 percent. This is a far cry from the previous two decades, including the 2000s, when the rate was over 2 percent. Rapid expansion during this period shaped the El Paso’s housing market for many years to come.

Over the past few years, local residential real estate has grown tremendously. Since at least 2014, home sales in the MSA have risen each year, an impressive trend given the overall slower pace of household growth compared with the prior decade (Figure 4). Most household growth in the 2010s was at the beginning of the decade due to military-related job relocations, but 2018 provided a mini-boost.

Overall job growth over the past decade has been positive with no major downturns. Several sectors, including federal government, hospitality, and healthcare, have sustained steady year-over-year growth. Additionally, the local housing market does not appear to be influenced by oil industry swings. In fact, housing activity during the most recent 2014 oil bust actually began a multiyear positive sales run.

Housing activity in 2019 essentially matched record housing sales from the year before, breaking a five-year growth cycle for housing sales. Part of this could be lagging trade uncertainty between the U.S. and Mexico as well as diminished manufacturing output. Those factors significantly affect the economies of both El Paso and cross-border neighbor Ciudad Juarez.

After the GR, Ciudad Juarez lost many manufacturing jobs. Those jobs returned at a tremendous rate in the 2010s, particularly after 2014. For perspective, manufacturing employment in Ciudad Juarez is currently more than a quarter of a million, whereas the entire labor force in El Paso is almost 370,000.

With its estimated population of around 1.45 million, Ciudad Juarez benefits El Paso economically in a number of ways, including retail, restaurants, and wholesale trade. Wholesale trade employment in El Paso grew at a rapid pace along with manufacturing employment between 2013 and 2018. Recent setbacks in Mexican manufacturing may explain some of the slowdown in El Paso retail, which began in mid-summer 2019.

Slowed housing market activity in 2019 could also simply be due to constrained supply. Single-family building permits are down, prices are still growing, and listed homes are taking less time to sell. These trends, combined with continued flat or negative home sales growth, could signal a market with remaining pent-up demand.

Since the initial burst following the Fort Bliss announcement, local new-home construction has declined. Without any increased output, tight housing market conditions are likely to remain in the region for the foreseeable future.

___________________

Roberson ([email protected]) is a senior data analyst with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.