Matters of Interest

Interest rates provide important clues about the nation’s economic outlook, even during times of crisis. For example, an analysis of interest rate movement as of Sept. 7 suggests the U.S. economy could be recovering from COVID-19’s impact during fourth quarter 2020. |

Movements in interest rates contain important and useful information about current and future macroeconomic conditions. For example, they can provide clues about the state of the U.S. economy since the COVID-19 outbreak. First, a little background.

The U.S. financial system has several varieties of interest rates, each with various risk premiums (e.g., default risks, prepayment risks, and inflationary risks) associated with investment in fixed-income securities, such as Treasury bonds and bills, municipal bonds, corporate bonds, and certificates of deposit. Investors in fixed-income securities have the option to allocate investment funds in fixed-income securities according to their perceived or expected risks associated with different securities.

Past movements of interest rates in the U.S. show that at the onset of actual or perceived economic downturns, investors reallocated their investment funds by investing less in risky financial assets, leading to falling prices of those risky assets. The flight to safety results in higher interest rates associated with more risky securities when fixed incomes from securities are divided by falling security prices.

Investors, market rates, and prices do just the opposite during periods of economic prosperity. Consequently, the spread between more risky securities and less risky ones (the interest rate on more risky securities minus the interest rate on less risky securities) trends upward at the onset of economic crises. After peaking, the upward trend reverses, and the spread reverts to its pre-crisis level.

Lessons from Past Economic Crises

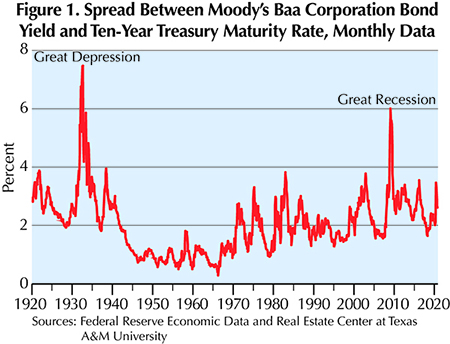

The spread between Moody’s seasoned Baa corporate bond yield and the ten-year Treasury constant maturity rate proved to be an important leading indicator of the U.S. macroeconomic conditions during both the Great Depression (GD) of 1929-33 and the Great Recession (GR) of 2007-09. The Real Estate Center monitors and uses it for forecasting U.S. and Texas macroeconomic conditions. In the GD, the spread began trending upward from 2 percent in November 1928 and peaked at 7.47 percent in June 1932 (Figure 1). Then it trended downward and fell to 1.81 percent in January 1937. The U.S. gross domestic product (GDP) in real terms fell 26.3 percent from 1929 to 1933.

In the GR, the spread began trending upward from 1.6 percent in June 2007 and peaked at 6.01 percent in December 2008 in the aftermath of the Lehman Brothers bankruptcy. After that, it trended downward to 2.4 percent in April 2010. Using quarterly data for the two interest rates and the U.S. GDP growth rates shows the higher (lower) the spread, the lower (higher) the GDP growth rates (Figure 2). At the peak of the spread in 4Q2008, the U.S. GDP fell 3.9 percent from 2Q2008 to 2Q2009. The correlation coefficient between the spread and the GDP growth rate from 1Q2000 to 4Q2019 was minus 0.76.

Interest rate movements are driven by financial decisions of lenders and borrowers as well as the monetary policies of central banks. Until the GR, changing the monetary policy rate (aka federal funds rate), open market operations, and bank reserve requirements were the main tools of the Federal Reserve (Fed) to attain its dual mandate of maximizing employment and controlling inflation.

Before the GR, the Fed’s main monetary policy instrument to influence short-term interest rates was changing the Fed funds rate, the overnight interest rate at which banks and other depository institutions lend money to each other. In response to the severe economic and financial crisis of 2007-09, the Fed implemented a monetary policy program, known as quantitative easing (QE), for purchasing ten-year Treasury bonds and mortgage-backed securities to lower long-term interest rates as well as reduce deflation risk. The Fed can now influence long-term interest rates by selling ten-year Treasury bonds and mortgage-backed securities purchased in the QEs.

COVID-19 Pandemic and Interest Rates

On Feb. 26, 2020, California announced the first COVID-19 case in the U.S. On March 5, Vice President Mike Pence announced that 21 people aboard the Grand Princess tested positive for the coronavirus. The same day, Austin canceled the SXSW conference and festivals, and President Donald Trump signed an $8.3 billion emergency spending package to respond to the coronavirus outbreak.

March 9, Moody’s Baa corporate bond rate (which was trending downward before the pandemic reversed direction) began trending upward from 3.45 percent to 4.94 percent on March 30 as flight-to-safety led bond investors to sell corporate bonds (Figure 3). Mortgage rates followed corporate rates and moved upward after March 9.

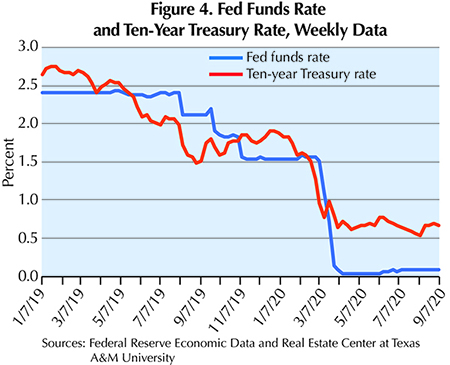

Stay-at-home and business-restriction orders issued by states limited economic activities to essential business operations. To help the U.S. economy recover from the adverse economic impacts of the pandemic, the Fed lowered the Fed funds rate, announced a new round of QE by purchasing Treasuries and mortgage-backed securities, and provided a wide array of financial assistance programs. By the end of April, the short-term Fed funds rate fell to its zero lower bound, and the long-term, ten-year Treasury rate fell to 0.61 percent (Figure 4).

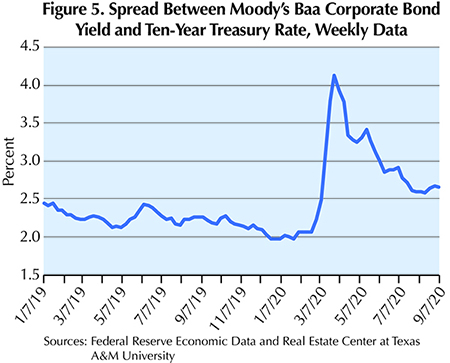

Using weekly data, the Real Estate Center’s indicator of the state of U.S. macroeconomic conditions once again proved to be a leading indicator of the nation’s economy. The spread between Baa corporate bond yield and the ten-year Treasury rate rose from 1.97 percent in the week ending Jan. 27 to a peak of 4.13 percent in the week ending March 30. As of Sept. 7, it had fallen to 2.66 percent (Figure 5). The falling spread suggests the worst may be over for the U.S. economy. This is confirmed by the falling insured unemployment rate (continued claims divided by covered employment) for the U.S since May 11 (Figure 6).

Help for Homeowners, Risk for Lenders?

The Coronavirus Aid, Relief, and Economic Security Act (CARES), the $2 trillion financial stimulus package, provided two protections for homeowners with mortgages if they experience financial hardship due to COVID-19:

- no foreclosures for 60 days after March 18, and

- mortgage forbearance for 180 days, with the possibility of another 180 days, if their mortgages are owned or backed by the federal government through Fannie Mae, Freddie Mac, Ginnie Mae, or the U.S. Department of Veterans Affairs.

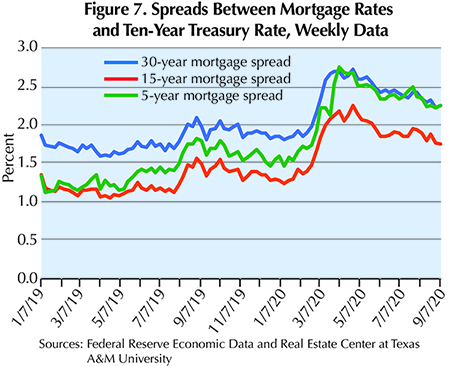

Figure 7 shows average spreads between the ten-year Treasury rate and mortgage rates of 30-year, 15-year, and one-to-five-year maturities. All three spreads trended upward after January 2020. The spread for the 30-year fixed-rate mortgage has been 1.66 percent since 1990, almost 100 basis points smaller than the 2.66 percent spread in March 2020.

Lenders have raised risk premiums included in mortgage rates in response to losses of jobs and income, foreclosures, and mortgage forbearance. The good news for borrowers and the real estate sector is that the spreads have been trending downward since July 2020.

____________________

Dr. Anari ([email protected]) is a research economist with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.