2020 Texas Housing & Economic Outlook

You might also like

TG Magazine

Check out the latest issue of our flagship publication.

Helping Texans make the best real estate decisions since 1971.

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

We offer a number of educational opportunities throughout the year, including our popular Outlook for Texas Land Markets conference. Check here for updates.

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

The U.S. and Texas economies are expected to slow in 2020 but still register solid positive growth.

In an environment of slow economic growth and well-anchored inflation expectations, the Real Estate Center expects interest rates to remain low with possibly another rate cut by the Federal Reserve of around 25 basis points. The rate cut will depend on whether weaker than anticipated economic growth occurs and/or if the trade disputes continue or escalate.

Last year, the Center predicted a slowdown in the U.S. and Texas employment that will continue through 2020. The labor market should tighten with upward pressure on wage growth.

The border metros will suffer from the U.S. and world manufacturing slowdown and low economic growth in Mexico. World economic growth will remain sluggish, especially if a U.S.-China trade agreement is not resolved.

Headwinds related to trade relations with China and slowing global economic growth will create uncertainty for business investment and hamper economic growth in the process.

Based on the current crude oil price trajectory (in the $50s per barrel), drilling activity should gradually slow in 2020. For now, investors have little interest in the oil and gas sector. As a result, capital market constraints will hamper drilling expansion.

Growth in oil-and-gas-related employment will be stifled as well. Job losses in mining employment statewide could occur.

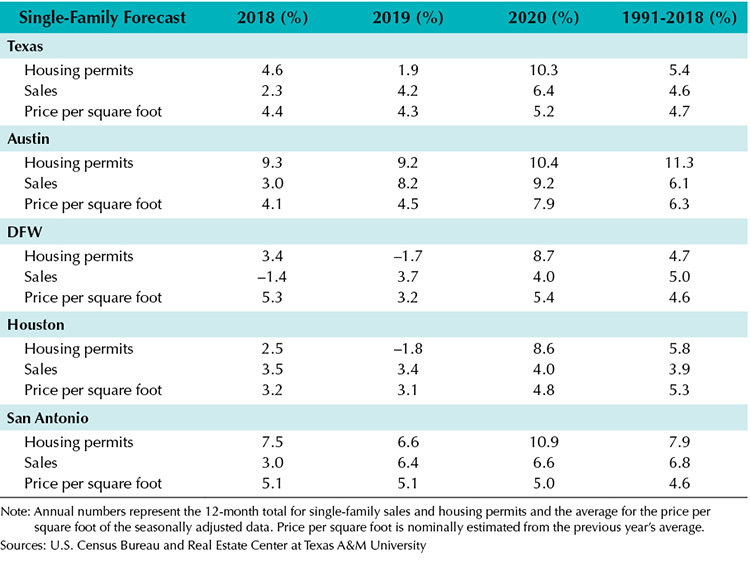

Low mortgage rates and steady employment growth will support ongoing housing demand in 2020, resulting in a greater number of sales and higher prices than in 2019.

On the supply side, increased single-family permits, housing starts, and lot development indicate positive momentum for construction in 2020. Builders are trying to build homes priced from $150,000–$350,000.

The strong run-up in single-family home prices over the past few years will reduce affordability given that household incomes are increasing at a lower rate than prices.

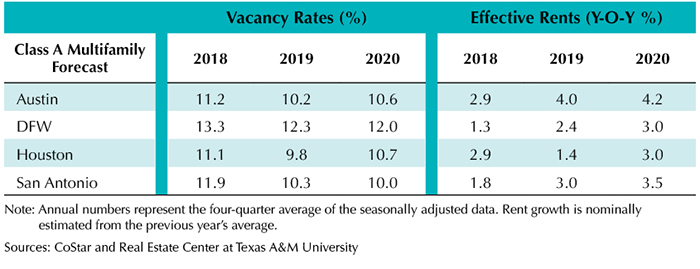

Texas’ apartment markets should continue to perform well in 2020 given the low inventories of starter homes available for purchase by young adults. Millennials, still in their 20s and early 30s, continue to show more interest in leasing than buying. Consequently, vacancies should remain relatively low and rents will continue to increase.

Texas industrial markets have been quite strong in recent years. However, uncertainty over U.S.-China trade negotiations could negatively impact the market in 2020 if there is no resolution or if the trade war escalates.

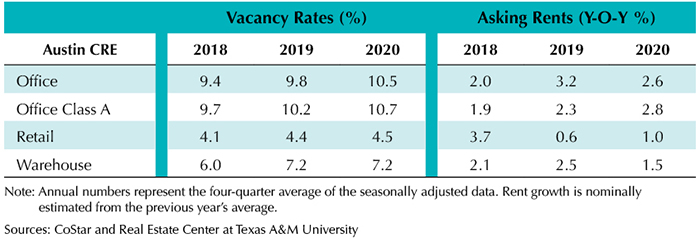

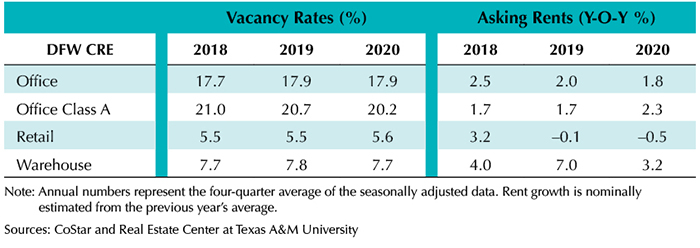

The retail sector should continue to perform well in 2020 with muted new construction combined with solid consumer spending.

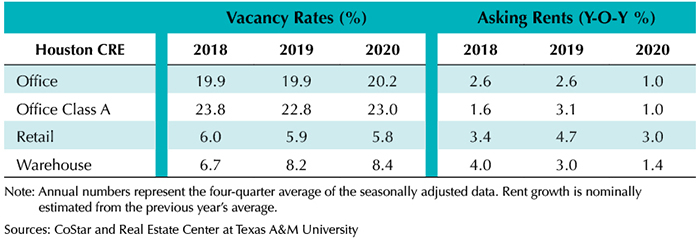

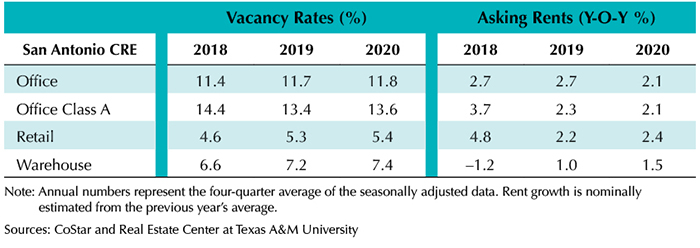

Austin, DFW, and San Antonio office markets will continue strong. Houston, however, faces challenges with flat oil and gas activity, lingering negative effects from the 2014 oil bust, and aggressive levels of new construction.

Overall, the Center expects slower rent growth in non-residential commercial real estate in 2020.

Based on current trends, the Center expects:

Activity may vary by region.

Receive our economic and housing reports and newsletters for free.

As the state’s population grows, so does the need for more housing. Here are the data and tools you need to keep up with housing market trends in your area.

Whether you’re talking about DFW’s financial services industry, Austin’s tech sector, Houston’s energy corridor, or the medical hub that is San Antonio, commercial real estate is big business in Texas.

Mineral rights. Water issues. Wildlife management and conservation. Eminent domain. The number of factors driving Texas land markets is as big as the state itself. Here’s information that can help.

Texas is a large, diversified state boasting one of the biggest economies in the world. Our reports and articles help you understand why.

Center research is fueled by accurate, high-quality, up-to-date data acquired from such sources as Texas MLSs, the U.S. Bureau of Labor Statistics, and the U.S. Census Bureau. Data and reports included here are free.

Stay current on the latest happenings around the Center and the state with our news releases, NewsTalk Texas online searchable news database, and more.

We offer a number of educational opportunities throughout the year, including our popular Outlook for Texas Land Markets conference. Check here for updates.

Established in 1971, the Texas Real Estate Research Center is the nation’s largest publicly funded organization devoted to real estate research. Learn more about our history here and meet our team.

Helping Texans make the best real estate decisions since 1971.

You are now being directed to an external page. Please note that we are not responsible for the content or security of the linked website.