Dirt Isn’t Cheap . . . Anymore

The Takeaway Rising land costs contribute to rising home prices. As land costs increase, they account for a larger portion of a home’s overall price. In 2016, land accounted for an average of 20.4 percent of the cost of a home in Texas. That’s less than the average for the nation and most-populated states. |

Rising land prices in Texas have played a role in the state’s overall rise in housing prices, but to what extent?

Real Estate Center research finds that market forces on both the demand and supply sides of the state’s housing markets have contributed to the state’s rising home prices since the Great Recession (GR). On the demand side are higher growth rates for the state’s economy. On the supply side are land prices, which are increasing and making up a growing percentage of a home’s overall price.

Land accounted for 20.4 percent of the cost of a single-family Texas home in 2016, less than the nation’s 33.5 percent and less than the corresponding shares in the largest states by population. At the metro level, Dallas had the largest share of land as a percentage of home cost (29.4 percent), followed by Houston (25.1 percent), Fort Worth (22.4 percent), and San Antonio (15.2 percent). Data were not available for Austin.

Comparing State, National Prices

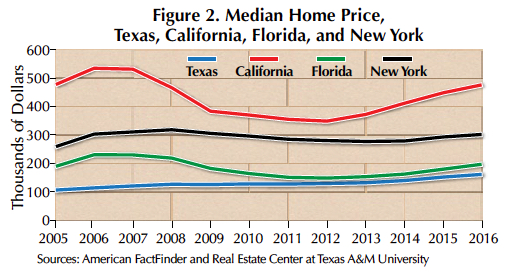

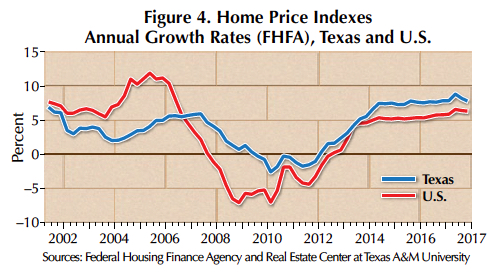

At least as far back as 2005, Texas residents have been enjoying more affordable homes than U.S. residents as a whole as well as those in states with the largest populations (Figures 1 and 2). Median prices of Texas homes trended upward from $106,000 in 2005 to $161,500 in 2016. That’s lower than the corresponding nationwide median prices of $167,500 to $205,000, but the price gap has narrowed since 2011 (Figure 1). The narrowing gap between Texas and U.S. median home prices has been mainly due to Texas’ higher price growth rates since 2007 (Figure 3). Home price indexes published by the Federal Housing Finance Agency (FHFA) and Lincoln Institute of Land Policy also show that Texas home price growth rates have been higher than the nationwide averages since the GR (Figures 4 and 5).

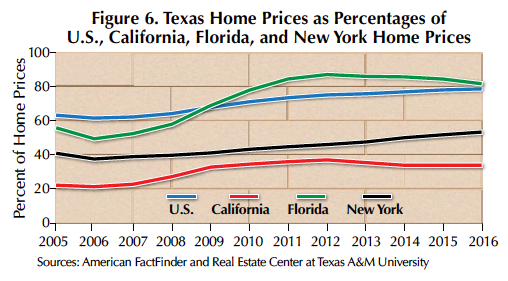

Texas’ median home prices as percentages of national median prices trended upward from 61.6 percent in 2005 to 78.8 percent in 2016 (Figure 6). The state’s median price was 33.8 percent of California’s, 53.4 percent of New York’s, and 81.7 percent of Florida’s prices in 2016 (Figure 6).

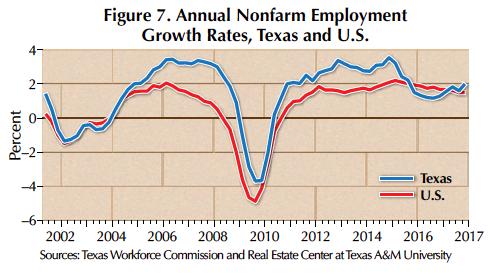

Texas’ more affordable home prices have played a key role in the state’s economic growth, attracting more people from other states and resulting in more demand for goods and services, higher economic growth rates, and more jobs attracting more people. Since 2005, Texas has outpaced the U.S. in employment growth and gross domestic product output in real terms in all years (except recently because of lower oil prices and Hurricane Harvey) (Figures 7 and 8). However, that same economic growth is largely responsible for the state’s home price growth rate outpacing the nation’s.

Texas’ home prices have been comparatively low mainly because of its abundant supply of low-cost land and efficient land-acquisition process (regulations affecting costs of land acquisition and preparation such as costs of title to a property, zoning requirements, covenants and deed restrictions, easements and right-of-way restrictions, costs of surveying and boundary markers and so forth).

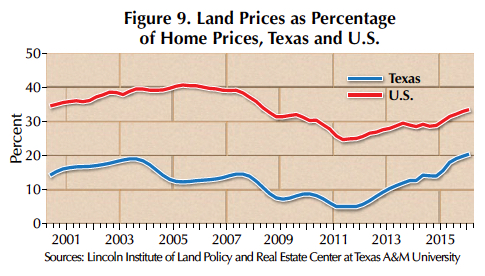

Historically, land cost as a percentage of home price for an average-size, single-family home in Texas has been lower than national averages and much lower than California, New York, and Florida (Figures 9 and 10). Land costs accounted for 14.1 percent of Texas home prices in second quarter 2000 compared with 34.4 percent for the U.S. Those percentages trended downward in the GR, falling to a trough of 5 percent for Texas and 24.8 percent for the U.S. in third quarter 2011. They trended upward in the aftermath of the recovery, reaching 20.4 percent (Texas) and 33.5 percent (U.S.) in first quarter 2016. Texas’ upward trend since 2011 has been similar to California’s but less steep than Florida’s. New York had a mild downward trend. Despite growing shares of land costs, Texas had the lowest land share cost in first quarter 2016 compared with California (61.1 percent), Florida (31.4 percent), and New York (31.2 percent).

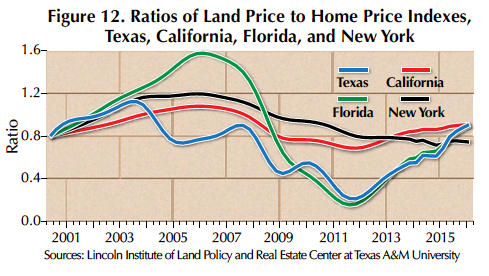

When land price growth outpaces home price growth, land cost accounts for a larger portion of overall home cost. To investigate growth rates of land prices in relation to home prices, the Center computed the ratios of land price indexes to house price indexes for Texas, U.S., California, Florida, and New York (the indexes being equal to one in second quarter 2000). The ratios for both the U.S. and Texas trended downward in the GR, falling to 0.27 for Texas in fourth quarter 2011 and to 0.77 for the U.S. in second quarter 2011 (Figure 11). Since 2012, they have trended upward, reaching 1.14 and 1.04 for Texas and the U.S., respectively.

Texas had a steeper upward trend than the nation, surpassing the U.S. in 2015. Texas’ upward trend paralleled Florida’s trend (Figure 12). California’s trend was less steep than Texas’ trend, while New York experienced a mild downward trend.

Comparing Texas Metros

Historically, Dallas’ land shares of home prices have been the highest among the state’s largest metros (Figure 13). Fort Worth’s land shares were larger than Houston’s shares before the GR, but Houston’s shares have exceeded Fort Worth’s shares since the recovery. San Antonio’s land shares of home prices have historically been the lowest of the four metros.

Land shares of home prices for the four metros trended down before and during the GR but have trended up since the end of 2011. Houston’s land-share trend has been steepest, increasing from 7.1 percent in fourth quarter 2011 to 25.1 percent in first quarter 2016, followed by Fort Worth (5 to 22.4 percent), Dallas (14 to 29.4 percent), and San Antonio (5 to 15.2 percent).

The ratios of land price index to home price index for these metros trended down before and during the GR but have trended up since 2012 (Figure 14). Houston had the steepest rise (0.31 in fourth quarter 2011 to 1.18 in first quarter 2016) followed by Fort Worth (0.13 to 0.60), Dallas (0.36 to 0.79), and San Antonio (from 0.15 to 0.49).

____________________

Dr. Anari ([email protected]) is a research economist and Dr. Gaines ([email protected]) the chief economist with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.