How the West Was Won

In the end, clouds of doubt dispersed, seas of conflict parted, and everyone came together to accomplish the improbable sale of a storied Texas ranching empire that dated from the 1850s. Despite a legendary family feud that had fascinated generations of Texans, the transaction concluded with all parties agreeing to the terms. Rural land brokers Bernie Uechtritz (International Icon Properties, consultant to Briggs Freeman Sotheby’s International Realty) and Sam Middleton (Chas. S. Middleton and Son) guided the process to an ideal outcome despite repeated dark warnings about the futility of the undertaking.

In the end, clouds of doubt dispersed, seas of conflict parted, and everyone came together to accomplish the improbable sale of a storied Texas ranching empire that dated from the 1850s. Despite a legendary family feud that had fascinated generations of Texans, the transaction concluded with all parties agreeing to the terms. Rural land brokers Bernie Uechtritz (International Icon Properties, consultant to Briggs Freeman Sotheby’s International Realty) and Sam Middleton (Chas. S. Middleton and Son) guided the process to an ideal outcome despite repeated dark warnings about the futility of the undertaking.

Middleton recounted early admonitions from formerly interested would-be buyers.

"I don’t know how many people I ran into who said, ‘I tried to buy the Waggoner Ranch 15 years ago. You are wasting your time. You guys will never get this done.’"

"Everyone thought it would never happen," Uechtritz added.

We are honored and privileged to have been given the trust and responsibility to do the deal. It wasn’t an easy assignment, but we had a fairy-tale ending. We got it done with the unanimous decision of the families and receiver. Getting a unanimous decision wasn’t easy initially. There wasn’t a lot of love lost between them and the court-appointed receiver. Technically and legally, the families had lost control of the process of winding up the trust, the assets of which included the ranch, but they had continued operating the business and ranch as usual for more than 20 years. It (the sale) was a big thing for them both emotionally and legally.

A ranch of mythic proportions, the Waggoner Estate occupies more than 535,000 acres spread across parts of six counties north and west of Wichita Falls. The celebrated spread came to market despite a family dispute that saw the members at odds on virtually anything dealing with the ranch. The family patriarch, Dan Waggoner, and his son, W.T. Waggoner, built the empire with W.T. succeeding as owner when Dan passed away. In 1923, after his attempt to divide the ranch among his heirs engendered family bickering, W.T. placed the sprawling property into a legal entity known as a Massachusetts trust. This ownership left the heirs with no individual controls over the ranch. By the 1990s, the two families, as beneficiaries of the trust, clashed openly. When the trust eventually expired, triggered by its own terms, the courts ordered a sale of the assets. But one family opposed the idea of a sale so two receivers had made little progress toward that end. Many tried to buy the ranch, but none succeeded.

Eventually, the receiver charged with effecting a sale opted for an auction conducted by a consortium of agents. The auction would likely have resulted in dissolution of the property. Under that scenario, the ranch would be no more, passing into history as an artifact from a bygone era. Meanwhile, Uechtritz convinced the families that marketing the property conventionally with the aid of an internationally connected broker would provide the best opportunity to maximize their return and preserve the ranch intact. As Uechtritz explained:

The proposal by the consortium was to divide it into parcels and sell it piecemeal. There would have been landlocked pieces, pieces with no water, pieces with no value; it would have been the most illogical thing you ever saw. More importantly, it would have been a never-ending saga for the families that had already been in litigation for 22 years. To cut up the ranch with an auction would have meant ongoing litigations for another 100 years. The estate would never have been settled. The purpose of the receivership was to dissolve and wind up the trust established in 1923 by liquidating all assets of that trust. A process that ended with only some of it solved would have been a never-ending litigation nightmare.

Middleton noted, "The families bought into the idea that an auction was not the way to go. It was the first time the two families united on anything. That’s how Bernie and I got involved. The ranch would have lost its identity if it had been cut up in ten to 15 different units." Uechtritz and Middleton formed a working partnership charged, as Uechtritz describes it, with "a proposal, mandate, and plan to market the property to the four corners of the world, to market to every possible buyer at every possible level."

At the outset, the brokerage team faced unique challenges. First, Uechtritz and Middleton had never worked together. They began by establishing the roles each would play in guiding the transaction. As Uechtritz observed, "Sam Middleton and I were thrown into this deal together, and over the course of this deal became great friends; we’ve learned a lot from each other."

Middleton added, "When we started this process, it was evident that Bernie and I had vastly different styles, and he told me from day one, ‘Now mate, you’re going to be the steak, and I’m going to be the sizzle.’"

So Uechtritz concentrated on technology, marketing to the ends of the earth, and organizing needed information. He summarized the marketing push, saying:

We got on the covers of a lot of magazines. We started with the support of people around here, the Lands of America, Land Report, Dallas Morning News, Dallas Business Journal . . . to inform our state brokerage community and local markets that it was available. . . . So then I marketed internationally—CBS, Bloomberg News, CNN, and Sky News in Europe. We were on television a lot. I marketed the ranch in 180-plus countries in 40-plus languages in print, digital, and on television. There are only 193 countries in the United Nations, so we certainly reached a majority of them.

Meanwhile, Middleton focused on the physical and logistical aspects needed to show the ranch. After a 15-month marketing campaign, Uechtritz and Middleton had shown the ranch to qualified prospective buyers from both the air and on the ground. Middleton explained,

We were fortunate; the ranch had a four-passenger helicopter that was available to us anytime we needed. When people were serious buyers, I had a ground route pretty well done where I could show the high points of the ranch in about eight hours. So if the guy was interested, they would come in first and take a two-hour tour in the helicopter with Bernie, and then go on the ground with us. When the people got really interested, they usually came back and spent several more days on the ranch.

In the end, a total of about 50 showings involved 15 different individuals or groups from as many countries.

The second challenge came from the district judge and court-appointed receiver. "After all," Uechtritz said,

for the last 22 years, there had been a lot of brokers, both nationally and internationally, who wanted the deal. The ranch had not been officially on the market with a broker previously. It had been a long, drawn-out litigious situation as brokers and receivers came and went. But it was never ready to sell. It didn’t have a survey; it didn’t have a title; there was no signed agreement between the shareholders.

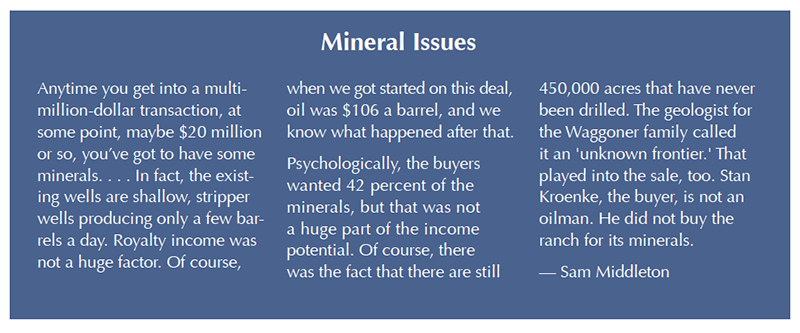

The confirmation of the listing took place on August 6, 2014, when oil sold for $106 per barrel. Middleton envisioned the most obvious buyer as a Dallas oil man. However, Uechtritz’s compressed international marketing plan and timeline as submitted for approval by the judge included both a call for offers and for all contingencies to be removed before presentation to the judge for final approval, a daunting condition. As Middleton recalled that condition, he mused, "…everyone knows that in today’s world, I guess nearly every deal you ever have has a contingency or due-diligence period or inspection period." With no completed title and no completed survey and at that time no signed agreement from the owners to sell, other than a listing from the receiver, Uechtritz and Middleton faced a challenge as they sought to deliver a viable buyer for the ranch who would also step up and accept the tough deal points.

Uechtritz and Middleton realized that securing offers from potential buyers with no contingencies called for exhaustive disclosure of all relevant factors affecting operations of the enterprise. To meet these requirements, they assembled a due diligence virtual data room stocked with mountains of information about the ranch. The team aimed to anticipate and deal with any potential pitfalls before a buyer signed the "no contingency" contract. Assembling all of that information required teamwork and considerable knowledge about the technology used to organize and present it. As Uechtritz noted,

. . . deals like this don’t happen because of one guy, they don’t happen because of two guys. . . . We all knew what we were doing, but we had help, and we had layers of teams behind this and people in our company. Sam had his son Charlie as his right-hand tech and support guy who meshed with our team. And I had my right-hand guy, Will Beuck, back of the house. He organized all the data along with the rest of my team and various others on call on an as-needed basis. I also worked very closely with both lawyers and the Waggoner management the whole way through.

In the end, would-be buyers could use that data warehouse to manage the risk inherent in the purchase of real property thanks to the talent and hard work invested by the teams.

"It was amazing the amount of information we had to have available to these serious players. We had to have anything that a buyer would want to know in that data room," said Middleton.

While noting that the envisioned Texas oil man did not emerge as a contender, Middleton observed, "Well, you know what happened to oil."

The final chapter began when on September 1, 2015, a call went out for offers. As Uechtritz describes the process:

I’ve had a lot of success by putting a definitive time frame to a campaign. By marketing for a period of time . . . while you have to keep your finger on the pulse of the marketing response, at a certain point, you should make a call for offers. It might be a call for first offers or final offers. You have to set metes and bounds. You have to be able to draw a line in the sand for everyone, for your sake and your client’s. That is a turning point in any campaign because it lets you know exactly where you are, and it lets your clients know where you are. That was exactly the case in this instance, and in fact, a critical part of my submitted plan for the Waggoner Ranch sale.

We gave them (would-be buyers) 30 days to get their offers together and really show us the money. Everybody in the final group was financially prequalified. That was part of the process early in the marketing. It also kept us sane and sensible and kept us down to about 50 showings for people who could actually afford the ranch. Whether the ranch worked for them or not is another story. We were looking for proof of ability and competency to close.

From the outset to finish, the marketing campaign generated about 900 inquiries. Geographically, approximately 48 percent came from Texas, 38 percent from the remainder of the country, and 15 percent the rest of the world. Many of the inquiries were not credible, so instituting financial and background checks plus drawing the line in the sand resulted in five making the final cut. Final conditions required those five to deposit $15 million in earnest money to have an opportunity to present their offers. The winning buyer then added a substantial sum to proceed to the closing.

Choosing and approving an offer provided the final challenge for the team. The potential buyers assembled and presented their proposed offers to the families. Middleton noted,

The good thing about bringing in the five finalists to meet was that the families did not have to approve the sale. The sale was approved by the receiver and the judge. However, we wanted the families to be on our side and not appeal the decision. By bringing in five different offers, the families knew we had researched the ranch, and this is what it’s worth. The five qualified groups or individuals made various offers that varied a couple of hundred million dollars.

The families were convinced we had done our job, and this is the best we are going to do on the offers. So the families got on board, and they actually signed the contract. They approved the sale. When we went to the courthouse, it was a slam dunk.

The winning offer came from Stanley Kroenke, billionaire owner of the NFL’s Los Angeles Rams and a string of ranches in Montana, Wyoming, and Canada. His involvement also brought a third ranch broker to the transaction. Joel Leadbetter, managing director of the Bozeman office of Hall and Hall, served as a buyer’s representative in the acquisition. Leadbetter became an important contributor to the ultimate outcome of the sale. As Uechtritz noted,

Sam and I were the listing brokers and—importantly for all you listing brokers out there—we had a great partner in Joel. You don’t get deals done by yourself. You’ve always got to have a buying broker to make us listing brokers look good, and he certainly did that.

We had thousands and thousands of meetings in the listing and sale process and beforehand and certainly during the negotiation process. When I was on conference calls for hours at a time with 16 lawyers, never once did I hear a reference to "Brand X." When we sat around countless meetings and countless tables, never once did I look across the table and see "Brand Y." I saw Joel, I saw Sam, I saw lawyers, I saw family members. I never saw a "brand." Joel and I established a rapport and a pact of absolute trust in each other from day one.

I think that is important to remember when you’re out there trying to do tough deals or hard deals or any deal at all. It’s not a brand that comes in across the line, it’s you—your tenacity, your personality, your perseverance, your chutzpah, your ideas. It’s what you know. . . .

By putting aside ego and concentrating on guiding the process to a successful conclusion, the team (brokers, families, judge, receiver, and buyer) crafted a "fairy-tale" outcome. The families, the judge, and the receiver all approved the deal.

"They unanimously, and I mean unanimously, agreed that Stan Kroenke was the right steward to take over the great legacy of the W.T. Waggoner Ranch," said Uechtritz, speaking of the final decision.

The closing on Feb. 10, 2016, was followed by a reception at the Red River Museum in Vernon.

"Both families were among the 50 to 60 attendees. It was a very emotional affair. At that reception, Kroenke really learned what he had. He said, ‘I never realized how important this ranch was to these families.’ It really meant a lot to him," said Middleton.

Summarizing the experience, Uechtritz said,

The sale of Waggoner Ranch, with a rough start, had a fairy-tale ending, and I think that’s very important. Important for agribusiness, for the rural sector, for some of our founding fathers and roots of this country, and this state, for the Texas and Southwest Cattle Raisers Association, the American Quarter Horse Association, the towns of Vernon, Electra, and Seymour, and all the towns in this great State of Texas.

The new owner is a land steward, he’s not a subdivider; he’s not a developer. He runs a great cattle operation in the United States as well as Canada. Stan Kroenke is going to keep it together. He is going to make it bigger and better.

Middleton added: "I think the families now realize they did the right thing. They can separate and go their ways. Both sides are very wealthy. They can stop fighting. At the end of the day, everyone was glad it happened."

The sale of the Waggoner Ranch completed the dissolution of the trust as designed, and marked the final chapter of the compelling saga of the Waggoner family guiding this enterprise from the frontier to the current day. The new owner takes the helm with a unique appreciation for the traditions surrounding the ranch and its place in Texas history. In the end, what seemed to be an impossible task brought brokers, families, attorneys, and a host of affected employees and communities together to participate in a truly historic event as the stewardship mantle passed to a new owner, guiding the property into a new era.

____________________

Dr. Gilliland ([email protected]) is a research economist with the Real Estate Center at Texas A&M University.

You might also like

Publications

Receive our economic and housing reports and newsletters for free.